The incomes of communities of the Mykolaiv region increased by 22% compared to the pre-war period

- News of Mykolaiv

-

•

-

- Olena Kozubovska

-

•

-

14:12, 28 November, 2024

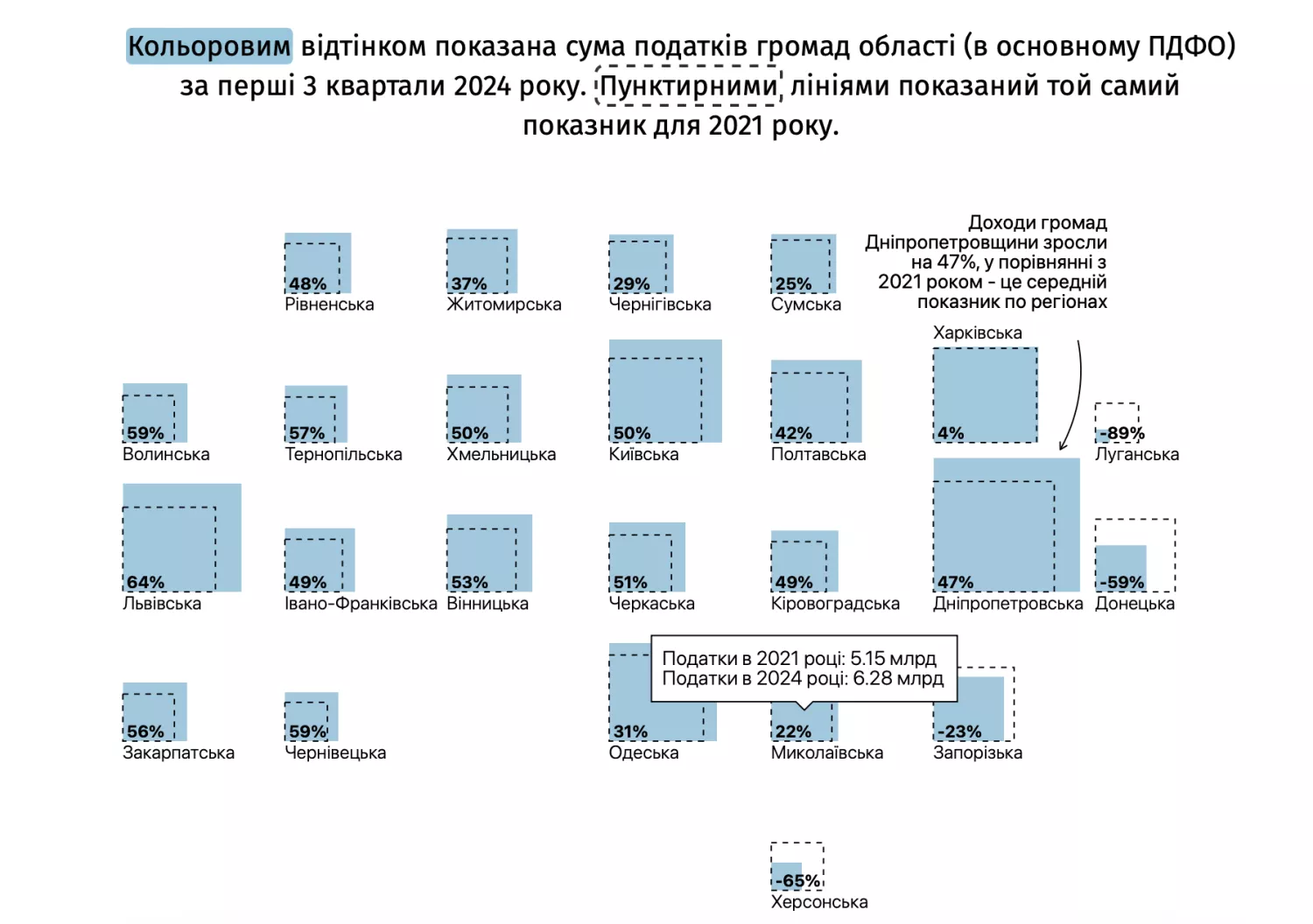

The incomes of the territorial communities of the Mykolaiv region for the three quarters of 2024 increased by 22% compared to the pre-war year of 2021. The total amount of tax revenues to local budgets reached 6.28 billion hryvnias against 5.15 billion in 2021.

This is stated in the analysis of the incomes of Ukrainian communities conducted by «Economic Truth».

In the Odesa region, community incomes increased by 31% — from 12.46 billion hryvnias in 2021 to 16.28 billion hryvnias in 2024.

On the other hand, the situation in the Kherson region is radically different: the revenues of local budgets have decreased by 65%. In 2021, communities received 3.83 billion hryvnias, and in 2024 — only 1.33 billion. According to this indicator, Kherson region is second only to Luhansk region, where the drop reached 89%, and is approaching Donetsk region, which lost 59% of its income.

The largest increase in income was recorded in the Lviv region, where communities increased their income by 64%, up to 20 billion hryvnias in the three quarters of 2024.

The main source of replenishment of local budgets remains the personal income tax (PIT). The tax rate is 18%, and more than 60% of the collected funds remain in the budgets of territorial communities. The largest increase in income in 2022-2023 was provided by military personnel due to the increase in their number and salary increase. However, only those communities where military units are located experienced a significant increase in income.

What about military personal income tax?

As part of the law «On the state budget for 2024», the Cabinet of Ministers decided to direct all revenues from personal income tax of military personnel, 64% of which previously remained in local budgets, to the state budget. The Association of Cities of Ukraine noted that they believe that these funds, most likely, will be dissolved in the state budget, as well as 36% of personal income tax, which was previously administered by the Ministry of Finance. It is about 25.8 billion hryvnias in 2023 and 93.7 billion hryvnias in 2024, Prime Minister Denys Shmyhal clarified earlier.

After that, it became known that the Verkhovna Rada of Ukraine can allocate over 517 million hryvnias to the communities of the Mykolaiv region to compensate for the loss of personal income tax from military income.

On October 6, 2023, it was reported that the Budget Committee of the Verkhovna Rada reviewed the decision on the draft law on personal income tax from the military and made amendments: from October 1 to December 31, 2023, the «military» personal income tax is directed to the state budget in the ratio of 50% to 50%. One part of 13 billion hryvnias will go to the State Service for Special Communications and Information Protection of Ukraine for drones, and the second part, also 13 billion hryvnias, will be directed to the Ministry of Defense for the purchase of artillery systems.

The mayor of Mykolaiv, Oleksandr Sienkevych, said that the city budget lost 3.4 billion hryvnias in revenue due to the withdrawal of the military personal income tax. He added that the city council will reduce the number of employees due to the reduction of the city budget by almost two times. Ernst&Young, in particular, is working on this.

Earlier, the mayor also expressed the hope that the military personal income tax withdrawn from the budget of Mykolaiv will be directed to the manufacture of weapons, in particular, drones for the Armed Forces of Ukraine.

Prior to this, people's deputies commented on the situation with the possible loss of the military personal income tax. In particular, People's Deputy from the «Servant of the People» party Artem Chornomorov criticized the Ministry of Finance and the budget committee of the Verkhovna Rada of Ukraine due to the decision to withdraw the personal income tax paid by the military from the budget of Mykolaiv.

During the session of the Mykolaiv City Council, he stated that he will not support the 2024 state budget unless it is amended to leave the personal income tax paid by military personnel in frontline communities.

People's Deputy of Ukraine Maksym Dyrdin announced that he will not make any amendments to the 2024 state budget for the Mykolaiv region. Unlike his colleague, People's Deputy Oleksandr Pasichnyi said that he is working on making amendments to the state budget for 2024 in order to balance the revenues of the city of Mykolaiv with subsidies after the loss of personal income tax (PIT), which is paid by the military.

People's Deputy of Ukraine Ihor Nehulevskyi said that he supports the removal of the military personal income tax (PIT) from the budgets of communities, because now the priority is the victory of Ukraine, so all other issues, including the everyday needs of communities, should be put on the back burner.

At the beginning of September 2024, the Association of Cities of Ukraine reported that less than half of the funds withdrawn from the budgets of communities to support the Armed Forces of Ukraine were used for the needs of the military. In particular, out of 77.3 billion hryvnias received as personal income tax, only 32 billion hryvnias were spent.

In September 2024, the mayor of Mykolaiv already lost 739.8 million hryvnias due to the withdrawal of the «military» personal income tax from Mykolaiv's budget, and in 2024 he did not receive 2.7 billion hryvnias.

However, in May 2024, Oleksandr Sienkevych reported that the filling of the city budget took place according to the planned indicators, which were determined after the loss of the military tax. He assured that «there is no negativity that could be expected.»